I. Summary Overview

World Bank is launching an International Working Group to Improve Data on Remittance Flows (the “Working Group”) under the auspices of KNOMAD and in coordination with top source and destination countries for remittances, and the IMF, UN, OECD, and Eurostat. The Working Group will also leverage and co-ordinate with the Global Remittances Working Group (GRWG). This proposal is being made against the call for timely and better statistics on remittances as these flows have become an important source of external financing in low- and middle-income countries. Accurate and timely data on remittance flows are necessary to enable decision-makers to enhance evidence-based policies and support the achievement of sustainable development goals (SDG). However, based on assessments made by a wide variety of users, there are gaps in the data and concerns about its quality.

The over-arching rationale of Working Group is to facilitate the coordination and information sharing among participants engaged in remittance flows data collection; compilation of methodologies and related activities, thereby establishing an effective and efficient system for monitoring developments. This will facilitate progress towards the comprehensive measurement of remittance flows in low- and middle- income countries, in conformity with internationally agreed standards and definitions.

The Working Group will also take responsibility for assessing the extent to which countries compile remittance flows data in conformity with internationally agreed standards and definitions and, for documenting deviations from agreed norms. The group will also serve as a discussion forum for proposed initiatives to further improve statistics on remittances by proposing best practices for capturing data sources and the compilation of methodologies, assisting in strengthening of basic statistics, further improving bilateral statistics, data dissemination and publication.

II. Current Challenges and Imperatives

The ‘International Transactions in Remittances: Guide for Compilers and Users’ (Box 1) was published more than a decade back. The growing importance of remittances as a source of external financing in developing countries as well as the rising significance of data on remittances in the global payments industry has revealed a need for more timely and granular data. One SDG indicator – the volume of remittances (indicator 17.3.2) requires more frequent and timely data on remittance flows and another SDG indicator - the cost of remittances (indicator 10.c.1) will benefit from accurate data on remittance flows.

The COVID-19 pandemic has further highlighted the need for frequent and timely data, especially in countries where remittances provide a financial lifeline to households and governments. In 2021, for the second year in a row, remittance flows to low- and middle-income countries surpassed the volume of foreign direct investment (FDI); excluding China, remittance flows surpassed the sum of FDI and official development assistance (ODA) (World Bank 2021). However, there are significant downside risks in the medium-term, necessitating careful risk management and continuation of efforts to keep remittances flowing. This is particularly relevant for countries where external debt is high, because remittance flows are now a key consideration in the assessment of debt and financial sustainability of developing nations.

Box 1: A Brief History of Efforts to Improve Data on Remittances

Following a 2003 World Bank publication highlighting the importance of remittances as a large and stable source of external financing, the G–8 Heads of State meeting at Sea Island in 2004 called on the Bank to lead an effort to improve the data on remittance flows. In January 2005, the World Bank hosted an international meeting with the objective of clarifying the needs of data users and agreeing on a strategy towards improving the availability and accuracy of data on remittances. In 2006, the Luxembourg Group on Remittances was created as an informal working group of data practitioners including participants from the IMF and the UN to make recommendations. In 2009, the Group’s recommendations led to the publication of the International Transactions in Remittances: Guide for Compilers and Users (RCG), under the auspices of the IMF,.

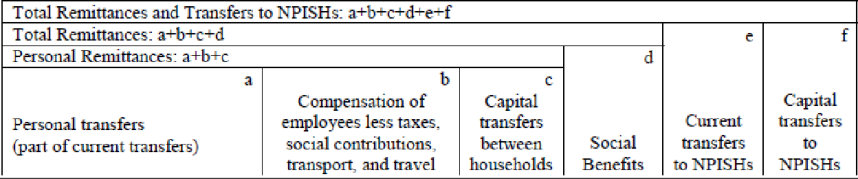

The Sixth Edition of the International Monetary Fund’s (IMF’s) Balance of Payments and International Investment Position Manual (BPM6) identifies the standard components and provides supplementary items to allow compilation of remittance aggregates. Following World Bank (2003, chapter 7), the standard components of remittances refer to personal transfers and the compensation of employees. Each component is defined in BPM6 as follows: (a) personal transfers – refer to all current transfers (in cash and in kind) between resident and non- resident individuals, and (b) compensation of employees – refers to the income of border, seasonal, and short- term workers who work in an economy where they are not residents. The Manual introduces three new concepts of remittances as summarized in figure 1. The supplementary components of remittances consist of personal remittances, total remittances, and total remittances and transfers to non-profit institutions serving households (NPISHs).

Interest in remittance flows statistics has risen steadily over the past few decades, but the quality of statistics remains unsatisfactory. Tourism revenues or FDI are often misclassified as inward flows of remittances; small trade payments, gifts to charitable organizations, or bank deposits are sometimes misclassified as personal remittances. Many countries are yet to transition to the new definitions and guidelines for data collection in accordance with BPM6, which affects cross-country comparability of data. Bilateral flow data are not available for most countries, and where available, it is likely that flows are largely attributed to the country where the intermediary bank is headquartered rather than the actual source. Data on flows though different channels, especially unregulated channels (including hand-carry and hawala) are not available. During the COVID-19 pandemic, remittances through digital channels have increased, but there are no granular data on flows through banks, money transfer operators, digital channels, telecom companies and shipping companies. More recently, crypto-currency-based value transfers seem to have increased in fragile countries or those facing high inflationary pressures, but there are no data to monitor such flows and could be more challenging to monitor. Indeed, data gaps continue to constrain our understanding of remittance behavior of different types of senders and recipients: refugees, transit migrants, and returnees; women and men; internal migrants or displaced persons; flows to family and friends. The COVID-19 pandemic has exposed major gaps in the timely availability of data on remittance flows. High-frequency data are not available for many countries. In some of the largest recipient countries, data are published with a lag of nearly two quarters. Outward flows seem to be estimated using outdated methodologies in many source countries, perhaps indicating a lack of attention to remittance flows.

III. Objectives of the Working Group

The Working Group will: (a) attempt to monitor progress in the implementation of the remittance data compilation guidelines in accordance with BPM6; (b) improve timeliness and granularity of the remittances data (frequency, corridors, channels, types of senders and recipients); (c) improve cross- country and time series comparability of remittances inflows and outflows; and (d) improve international cooperation in the collection, compilation and dissemination of remittance statistics, including capacity building.

To that end the Working Group would: (a) draw on analyses of data collected through existing mechanisms, (b) strengthen the network for information flows among various institutions; and (c) maximize the benefits of information captured within the framework of the Compilation Guide on Remittances, BoP/IIP.

IV. Participants

Participation will be solicited from international organizations (such as the IMF, Eurostat, the United Nations), national statistical offices and central banks of countries that are major sources or recipients of remittances. The list of relevant countries to be invited to include – for e.g., G-20 members, members of the Call to Action to Facilitate Remittances, and a few Small Island States and Fragile countries. The World Bank through KNOMAD will provide the Secretariat.

Duties and responsibilities of the participants will include the following:

- Improvements in source data for remittance flows (data gaps to be addressed; data collected to be adequate for the compilation of these stats) ▪ Money Transfer Operator (MTOs) ▪ Banks ▪ Other official channels ▪ Unregulated • Unregulated – in Kind • Unregulated - in Cash

- Capturing and analyzing the high frequency remittance flows data (monthly quarterly, Big Data)

- Improvements in staffing capacity (through training, especially on developing source data on remittance flows, compilation methods, and dissemination)

- Improving data compilation methodology for remittance flows (misclassifications mentioned above; inconsistency; duplications)

- Developing models of capturing/estimating the unregulated flows of remittances

- Improving remittance flows data dissemination practices (compile longer time series; bilateral breakdown; new data by country, by gender, by type/channel; clear distinction of personal transfers; compensation of employees; and travel services).

Remittance service providers and the civil society will be briefed and consulted at various stages of the Working Group’s deliberations.

V. FAQ

-

Is the Working Group fit with other existing discussions and efforts such as the discussions within the FSB?

This activity will complement ongoing discussions on remittances in the FSB and the G-20. The Global Remittances Working Group is a co-sponsor of this initiative. The group of countries participating in the Call to Action to Keep Remittance Flowing launched last year by the UK, Switzerland and KNOMAD/World Bank) had also supported this initiative to improve data. -

What is the number and the level of participants who can join the “International Working Group on Improving Data on Remittances?”

Many countries have nominated a principal and an alternate to the Working Group.

We have sent invitations to around 85 countries, the IMF and the Eurostat, requesting central banks to nominate a staff members (a principal and an alternate) with technical knowledge of balance of payments concepts and more specifically, of compilation of data on remittance flows (inbound or outbound). The staff members’ level would be in terms of experience and expertise and responsibilities to perhaps a lead economist or experienced senior economist level staff of the World Bank or the IMF. In many central banks, that might imply a director or head of the division level.

Some degree of flexibility may be required, that the nominee(s) may need to involve/consult other colleagues from their organization.

-

What are the countries that already expressed their interest in participating in the Working Group?

As of May 2, 2022, confirmations received from Austria, Azerbaijan, Croatia, El Salvador, Georgia, Germany, Italy, the Kyrgyz Republic, Mexico, the Philippines, Sri Lanka, Sapin, and the European Commission and the IMF.

VI. Process and Timeline

Thematic Groups: Members will be invited to join one or more of the following six thematic groups:

- High-frequency data on remittance flows (monthly and quarterly, Big Data)

- Remittance channels and instruments

- Bilateral remittance flows

- Types of senders and recipients (by type of migrants)

- Definition and data compilation guidelines (to address misclassification, improve comparability over time and across countries)

- Estimation of unregulated flows

Recognizing that these themes are not mutually exclusive, cross-cutting issues such as gender and type of migrants (for example, high-skilled and low-skilled, transit and return migrants, temporary and permanent migrants, forced and economic migrants).

Meetings: The first working meeting of experts will be held virtually, in three separate 2-hour sessions, in late May or early June 2022. These sessions will discuss and finalize the terms of reference of the thematic groups. After that, each thematic group is expected to meet 3 times as it prepares its report. The final report will be prepared by June 2023.

Members of the GRWG will be briefed on progress on a regular basis.